In a series of posts, we will explore how buyers can add more value to their organizations by getting involved to currency risk management. In Part 1 of our series, we will introduce buyers to basic finance and currency risk management principles. What does currency risk mean in general for the company? We will discuss this question through several case studies.

BUYER’S GUIDE TO CURRENCY RISK – Part 1

According to Investopedia’s definition, currency risk, also known as foreign exchange risk, forex risk, FX risk, or exchange rate risk, arises from the change in value of one currency in relation to another, and it can create unpredictable profits and losses.

Previously it was said that companies that have assets or business operations across national borders are exposed to currency risk. This is not true any more in today’s global world. A company having operations in a single country may as well face currency risk and may even go bankrupt if it does not properly manage such risks.

So here is my attempt for a definition:

Currency risk appears, when revenues, costs and certain assets and liabilities are denominated not in a single currency, but in various currencies; and/or when reporting currency is different from transaction currency.

Buyers are directly accountable as far as costs are concerned. Decisions about contracting goods and services in a particular currency will define FX structure of costs. (We will analyze how buyers should manage currency risk for purchase contracts in part 2.) On the other hand, world-class procurement professionals should look not only at costs, but also at assets, liabilities and revenues in order to have a more strategic and holistic view on currency risk. Perhaps not all readers are familiar with financial terms, such as “assets”, “liabilities”, “denominated”. So let us illustrate these concepts with an example.

Case studies

We will illustrate how currency risk affects financial results with some case studies.

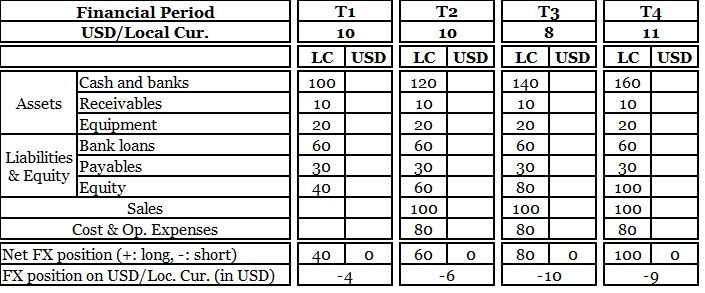

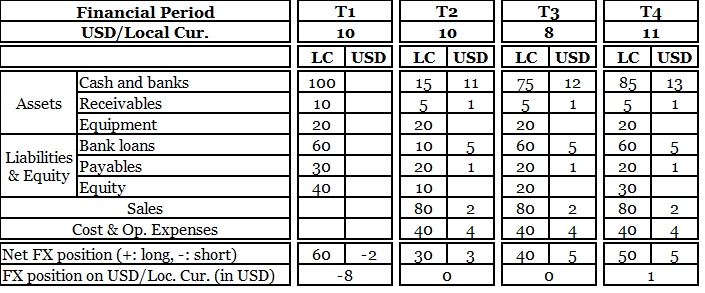

- We choose four dates and call them T1, T2, T3 and T4 (may it be month-ends or year-ends)

- We review three periods between these four dates (may it be months or financial years)

- We imagine a company operating in a country except the USA where there is a local currency

- FX rate of USD to LC (local currency) is fluctuating. (Flat in period 1. Appreciates in period 2. Depreciates in period 3.)

- We keep the company’s operational performance stable through three periods in order to focus only to the effect of currency fluctuation. Let’s say, company sells 10 units of goods in each and every period. Market price and cost of the goods stay basically at the same level, but currency composition may change.

- We demonstrate basic balance sheet items (only main assets and liabilities)

- We demonstrate basic P&L items (profit and loss) items

- Net FX position in each currency means certain assets (cash and banks and receivables, etc.), plus planned income for next period, minus certain liabilities (bank loans and payables, etc.), minus planned costs and expenses for next period. Equipment and equity are ignored in FX revaluations.

- FX position on USD/LC (local currency) parity is net USD position minus net LC (local currency) position, and it is measured in USD.

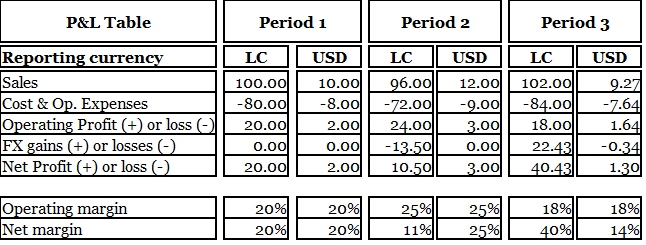

- We will analyze two different financial reports in each case – one in LC (Local Currency) and the other in USD. Let us remind that some companies report in local currency and some others report in another currency such as USD, EUR, etc. The latter is common for subsidiaries of global companies and for companies with shares listed at a stock exchange in another country.

We will start the simplest case and gradually progress by building on previous learnings.

Case 1:

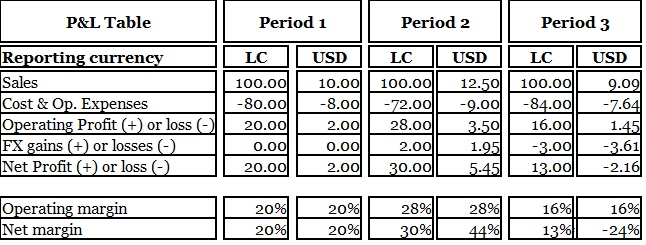

A simple company with all assets, liabilities, sale-purchase operations in LC (local currency)

As mentioned before, it is almost impossible to stay isolated from currency risk today. Our first case might be happening under very special circumstances in a closed market.

Reporting in LC: All operations are in reporting currency, so the company is free of currency risk.

Reporting in USD: Mediocre exposure to currency risk. (Long position in LC, no position in USD, and thus short position on USD/LC parity.)

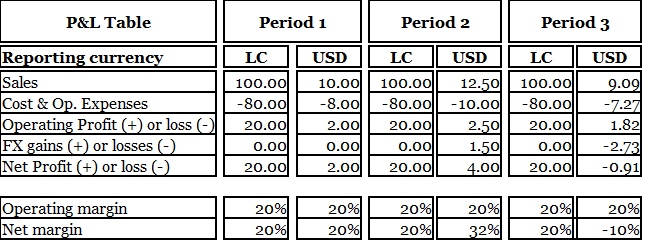

Reporting in LC: Financial results stable with operating and net margins at 20%.

Reporting in USD: Operating margin the same in USD and LC reports. Net margin varies depending on currency fluctuation. It is high when LC strengthens against USD, and vice versa. This is typical for consolidated financial statements of companies with subsidiaries in several countries.

Let’s recall that operations are actually constant over three periods and the company sells 10 units of goods in each periods. Nevertheless the company posts net profits if to report in LC and net losses if to report in USD in third period. So currency risk management is interesting, isn’t it?

Case 2:

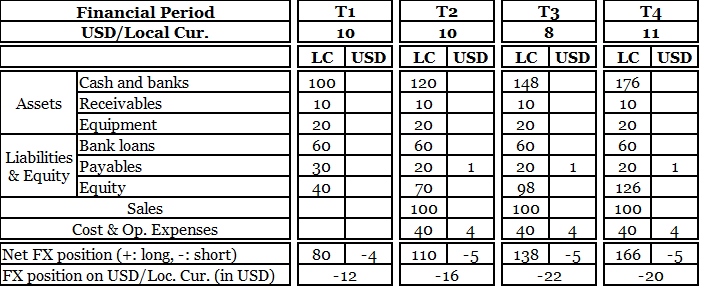

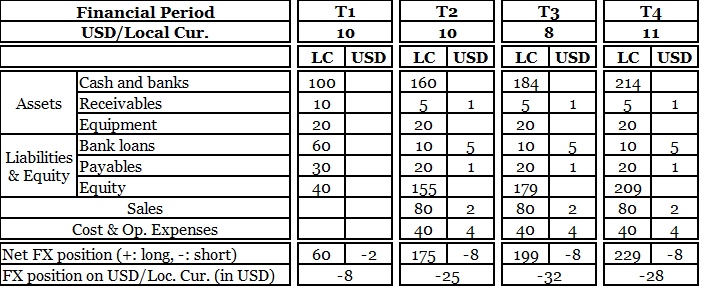

Sourcing some raw materials in USD

In this case, portion of costs and payables will be in USD as a result of purchase contracts concluded in USD.

The company will carry a serious short position in USD/LC parity, thus fragile to currency fluctuation.

Reporting in LC: Margins are not constant as in the first case. Now they react to currency fluctuation.

Reporting in USD: Currency effect is magnified. Net margin could go as high as 42% in period 2 and as low as -20% in period 3 depending on USD/LC rate.

Be it direct imports or contracts with local suppliers in foreign currency, many companies have to deal with some FX-denominated costs. So the second case reflects a more realistic picture.

Case 3:

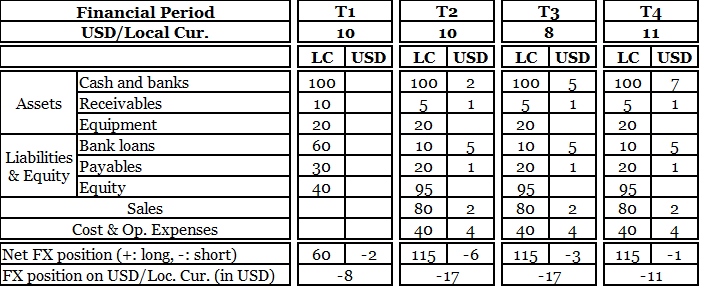

Some costs, payables, bank loans, and portion of sales in USD

Imagine that the management decided to grow business, took a loan in USD and invested into reaching export markets. Now there is a small USD-denominated income from exports however it is not enough to cover liabilities and future costs in USD.

Note that not all companies can start exporting goods easily. There could be certain barriers, such as global recognition of brands, logistics and regulations.

Bank loan in USD significantly increases short-position on USD/LC parity, so exposure to currency risk is higher than previous case. Different companies have different risk-appetite. The management might be consciously applying this strategy with an expectation of weak USD/LC rate.

The weak USD/LC forex rate maximizes returns in Period 2.

Reporting in USD: Net margin reaches record high of 58% in period 2 and record low of -58% in period 3.

Case 4:

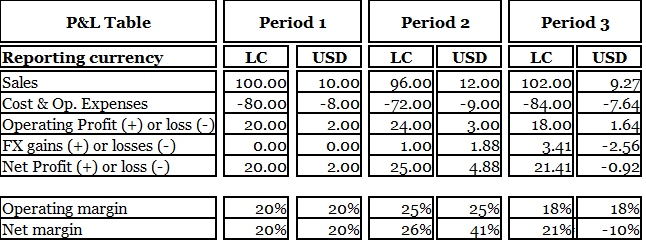

All profits converted to USD and kept in cash

Let’s imagine that the management starts converting idle cash to USD in order to further decrease short-position on USD/LC parity.

Having idle cash gives a strategic advantage to companies to hedge their currency risks. Note that short-position on USD/LC parity was decreased almost by twice compared two Case 3 just by converting sales proceedings from LC to USD.

What an improvement on financial results! The company manages to get more or less stable results if to report in LC. There is still a serious concern tough. Especially, if to report in USD.

Case 5:

Bank loans received in LC and converted to USD

This is basically “currency swap” and it is offered as a separate hedging instrument by many financial institutions.

Through currency swap, the company finally manages to balance position. There is neither long nor short position on USD/LC parity, which minimizes currency risk exposure for the company.

It is possible to say that the company stabilized financial performance.

KEY LEARNINGS

What buyers may take from this small exercise?

- Strive for close coordination between finance and procurement

- Learn the reporting currency of your organization and its significance in terms of currency risk management

- Analyze not only to cost elements, but have an understanding company’s financials in general

- Check whether there is idle cash or possibility to get bank loans for correcting undesirable currency positions

- Check whether the company has possibility to make exports or to find other source of income in foreign currency

- Understand the level of appetite for currency risk at your organization

WAY FORWARD

This was a brief introduction for buyers to basic finance and currency risk management. Of course, main focus of buyers should be on understanding and managing currency risks on purchase contracts. We will talk more about these topics on our next posts on 22 and 29 July.

Here is the spreadsheet file which I prepared for this exercise. You may have a look at it or play around with the figures to test other scenarios. It is in ODF (Open Document) format and does not require MS Excel application.