In a series of posts, we are exploring how buyers can add more value to their organizations by getting involved to currency risk management. In Part 3 of our series, we will focus on how buyers should measure and action currency risks. On previous parts, we made a brief introduction for buyers to currency risk. We discussed what currency risk means in general for the company on Part 1, and we examined the specifics of currency risk related to purchase contracts in more detail on Part 2.

BUYER’S GUIDE TO CURRENCY RISK – Part 3

Measuring exposure is a prerequisite for managing any risk, and currency risk is not an exception. Buyers should calculate the risk at their suppliers, and also at the suppliers of their suppliers. We will demonstrate it with a simple case.

Case Study

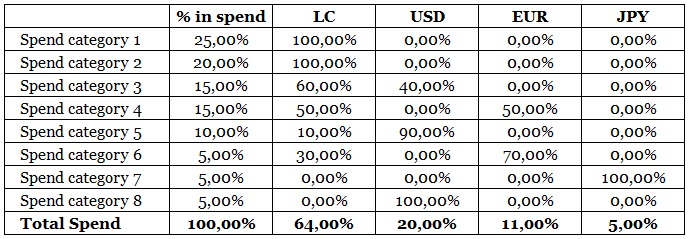

An ideal starting point is the good old spend analysis. Let us imagine that we have classified our spend into eight categories according to type of goods or services. We will then need to assess the currency risk per each category. Let us assume the following.

- Spend category 1: Major raw material. Sourced locally.

- Spend category 2: Major service. Sourced locally.

- Spend category 3: Local raw material supplier. They use a major commodity as raw material and process it further locally.

- Spend category 4: Raw materials. Working with two suppliers: One local, the other one from Europe.

- Spend category 5: Local raw material supplier. They are a distributor company importing from China and arranging logistics locally.

- Spend category 6: Local supplier of maintenance services. Maintenance company has local workforce but they use spare parts from Europe.

- Spend category 7: Foreign supplier of raw materials. The company imports directly from Japan.

- Spend category 8: Purchasing commodities from major exporters in country.

Spend categories 1 and 2 are quite straightforward and do not imply any currency risk. Category 7 is also straightforward, as direct imports will be fully in foreign currency. Remaining categories are interesting as they will consist of a mix in local and foreign currencies. Also, it is important that we measure the weight of each spend category in the company spend.

For spend category 3, it is assumed that we work with a local raw material supplier, which uses major commodity as raw material and process it further locally. In this case buyer should discuss with the supplier and clarify share of raw material input in foreign currency and share of processing costs and margin in local currency.

For spend categories 5 and 6, buyers should again assess currency risk exposure for the suppliers. It could be quite high for distributors of import products, as their local currency denominated costs are simply customs brokerage fees, storage and transportation costs. It would not be a surprise to see their foreign currency denominated costs as high as 80-90%. Note that the maintenance services supplier in our example (category 6) has a higher rate of local currency denominated costs than the importer/distributor (category 5). The higher the value-added locally, the lower the costs in foreign currency.

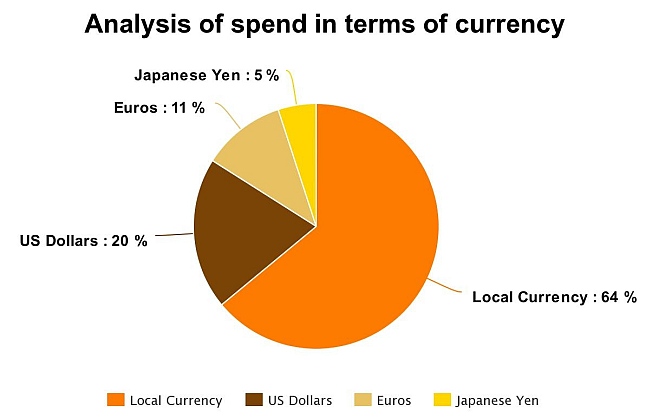

Now that we have analyzed spend categories in detail, the next step is calculating total spend in each currency by applying weight of each spend. The calculation shows that 64% of the spend is in local currency for this case. In other words, there is a currency exposure of 36%. You may have a look at the spreadsheet to see how these ratios were calculated.

Buyers should always have an update analysis of spend in terms of currency. They should share this information with their finance department and align a common strategy. Finance departments may choose to take these risks or to mitigate them through various techniques, such as financial statement management tools, as we have seen in Part 1 of these series, or financial derivative instruments, such as currency swaps, future contracts, option contracts, etc.

Key Learnings

- Avoid hidden costs for currency risk contingencies on your supply contracts. Encourage suppliers to share information transparently.

- Cooperate with suppliers to mitigate risks in most cost-efficient ways, through balance sheet management and hedging through financial derivatives at your or supplier’s side.

- Measure and demonstrate residual currency risks and consult with your finance department regarding further steps.